Assess Your house Financing Harmony Import Pros- EMI CALCULATOR

- Eligibility CALCULATOR

- Equilibrium Transfer CALCULATOR

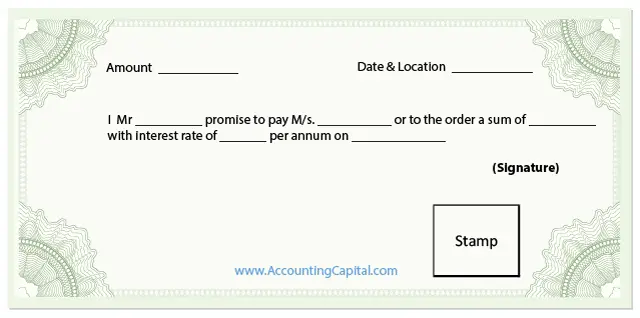

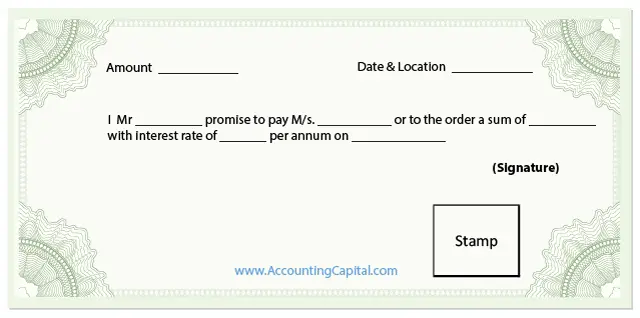

- STAMP Responsibility CALCULATOR

- Tax CALCULATOR

- Home loan Small Reads

- Simple tips to Make an application for A home loan

- Mortgage Tax Gurus

- CIBIL Rating Computation

Home loan Harmony Transfer Interest

Mortgage Equilibrium Import is a financial business through which you normally transfer the bill in your established Home loan to help you Bajaj Homes Loans to own a more competitive interest and better borrowing from the bank words.

Transfer your home Loan to us to take pleasure in rates just like the lower due to the fact 8.70%* p.a beneficial. to own salaried and you may top-notch individuals, with EMIs including Rs.748/Lakh*. You additionally make the most of stress-100 % free running, with minimal papers, home file pick-up service, and fast control.

Significant Top-upwards Loan away from Rs.1 Crore* or even more

Eligible individuals into loans Southside AL the best borrowing, earnings, and monetary reputation can be acquire a significant Finest-up Loan that can be used the casing goal.

Zero Prepayment otherwise Foreclosure Charge

People who have a drifting interest rate Mortgage do not shell out any additional charge after they prepay otherwise foreclose the financing during their tenor.

Outside Benchmark Linked Money

Borrowers likewise have the possibility to help you link their property Mortgage desire rates to an outward standard, for instance the Repo Price. Leggi tutto “Assess Your house Financing Harmony Import Pros”