Because of the investigating these different kinds of vacation home financing, you could potentially buy the choice you to best suits your financial situation and you can objectives. Always consult with a mortgage professional otherwise monetary advisor so you can see the certain criteria and you will implications of each resource alternative.

Income tax Implications and you can Rental Earnings

When it comes to a secondary domestic get, it is vital to understand the tax effects as well as how leasing earnings can impact financial support alternatives. Why don’t we speak about such issue in more detail.

Tax Considerations to own Vacation Homeowners

If you rent your trip home for more than just 2 weeks into the a-year, the interior Revenue Solution (IRS) often gather taxes on your own local rental earnings. This deal taxation implications that need to be felt whenever financial support a holiday family. It’s necessary to speak with a taxation elite group understand this new specific tax foibles one to affect your situation.

Running a vacation leasing property may render income tax masters. The latest Internal revenue service allows write-offs for different costs pertaining to local rental features, together with insurance coverage, home loan attract, repairs will set you back, and you can depreciation . These types of deductions might help counterbalance some of the costs associated with running and you may maintaining a holiday domestic.

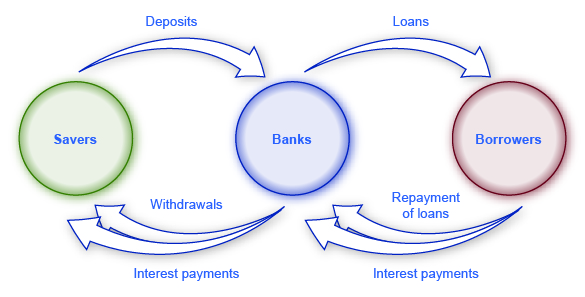

Leasing Earnings Impact on Resource

Whenever trying to get a home loan to own a holiday household, lenders tend to check out the possible local rental income while the a factor in the financing decision. Leggi tutto “The fresh leasing money might help demonstrate the property’s capability to make cashflow and cover the mortgage payments”