Put differently, in the event that an associate goes wrong or trips of the very own agreement (such, by abuse, wear-and-split, insufficient restoration, otherwise as the result of any sort of accident), a manufacturing plant warranty won’t make it easier to.

Instance, a direction controls procedure as a result of a credit card applicatoin problem otherwise awry strength direction system set up can result in a recall and you will repair secure under your factory assurance.

Different parts of a manufacturer warranty have been Riverside installment loans bad credit in push having various lengths of energy, according to the particular coverage considering. For example, bumper-to-bumper visibility is sometimes experienced more full part of a good facility guarantee but is most likely the first promise aspect of expire.

- Implied warranties: an enthusiastic unwritten promise one a good made use of automobile’s first functions performs and the vehicle operates.

- Minimal warranties: a kind of assurance one to specifies certain aspects and areas of the newest car or truck is protected and you will be maintained because of the dealer.

- Full warranties: guarantee totally free fix otherwise substitute for from safeguarded components and options contained in this new warranty months (despite owner). If an upkeep is actually impossible to complete, the auto proprietor was permitted a vehicle substitute for or complete refund.

Without a doubt, limited guarantees is actually most frequently provided by used-car buyers. not, dealerships will get as an alternative sell a vehicle as-is to attenuate otherwise completely reduce some otherwise every meant guarantees.

Prolonged guarantees usually are also known as services contracts, although several products are never a comparable. A great deal more confusing is the completely wrong interchangeability between prolonged warranties and you can MBI.

In the second case, lengthened warranties aren’t an insurance coverage equipment. Where insurance agencies give MBI, a bigger swath regarding organization could offer offered guarantees. Additionally, offered guarantees commonly given by only the brand name or agent.

Third-cluster or standalone longer warranties bring differing version of visibility based for the particular bundle, however, techniques repairs and don-and-tear are usually maybe not protected. In some cases, you may be capable pick wrap publicity who would spend to repair one thing other than the newest automobile’s powertrain.

Due to the fact prolonged warranties can differ therefore wildly when you look at the exposure, cautiously read over the insurance policy before purchasing they to be sure it supplies the safeguards you prefer and require.

3. Auto solution agreements

Car provider agreements try elective arrangements offered from the manufacturers, dealerships, and you can third-class team. They may be bought at once you buy a great brand new or used-car or later on, and therefore are designed for older autos otherwise people who have higher usage.

VSCs provide alot more comprehensive publicity than guarantees. Regular VSCs offer visibility for technical situations, along with relatively easy solutions – including cooling to your fritz – or maybe more pressing (and you may expensive) difficulties, like a system substitute for.

Auto solution contracts dont safety makeup affairs, program fix, or wear-and-tear. Specific VSCs also include an abundance of exclusions – certain bits or points perhaps not covered by the plan concerned.

Mainly because conditions are very specific, you happen to be accountable for paying for a fraction of an excellent repair that is otherwise secured if the a particular area is omitted of visibility.

4. Unsecured loans

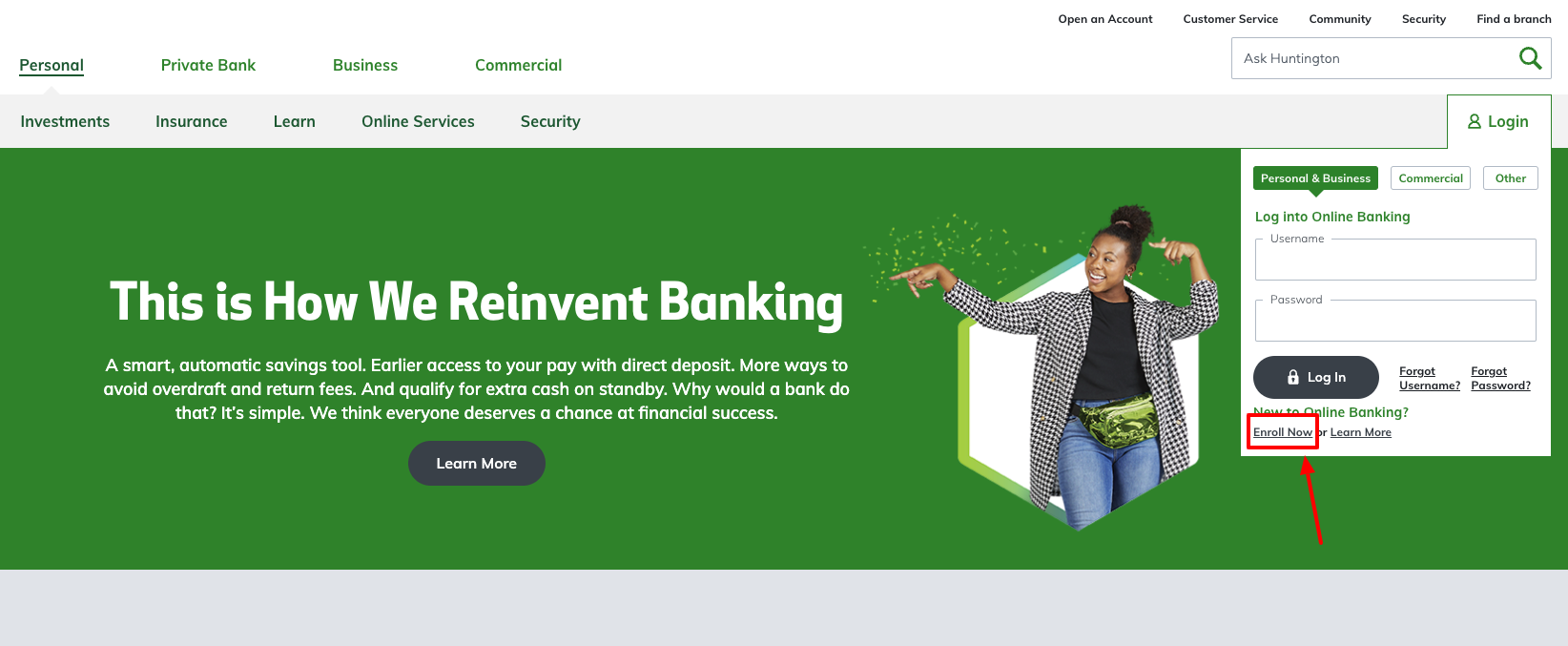

You could submit an application for a personal bank loan at your prominent lender or borrowing connection, and several even promote on the internet software. In some cases, unsecured loans is placed into your checking account because of the 2nd business day.

Family and friends also can offer a personal bank loan, even in the event be wary of just how personal it does score when borrowing from the bank of someone you know (and make certain not to ever take advantage of its generosity, either).

Currency borrowed compliment of a personal bank loan are used for any goal and, after that, any sort of car fix. So long as you use enough to coverage the brand new mechanic’s costs, you will be obvious and fantastic.