Minimal money called for all hangs considerably into the form of financing you’re looking for, should it be secured otherwise unsecured, the total amount, and the lender. Certain loan providers only require a small money (as much as $800 30 days), and many wanted even more (up to $20,100 annually).

Alternatives to Lower income Financing

- Payday loans: An instant payday loan (both named a primary put financing ) is a kind of personal bank loan that really needs earnings because is actually a short-identity financing you to definitely generally is anticipated to end up being repaid on your own 2nd pay-day.

- Secured personal loans: A protected consumer loan are going to give larger mortgage numbers however, get a secured item given that security if it is a vehicle otherwise a property. If you’re unable to afford the mortgage off, you then chance dropping the fresh investment.

- Borrow funds: You might use the cash from lots of source, including banking institutions, their colleagues, plus nearest and dearest.

- Credit cards: Handmade cards are of help you could purchase them on everything you particularly (spending expense, to order property). Per credit card will get a limit, but not, and certainly will must be paid back in advance of way more borrowing will likely be obtained.

- Borrowing from the bank Connection Signature loans: When you’re a member of a credit union, chances are they have a tendency to give funds which have all the way down charge and you will desire cost than traditional loan providers and banking companies. The fresh money operate in the same exact way because a simple individual financing, they simply require a subscription to make use of.

- Short-Name Money: Due to the fact term suggests, short-name loans are created to be distributed back within this several months. not, these are it is towards designed for people with excellent credit scores and so are highest earners.

What can I actually do Easily Usually do not Qualify for an individual Financing?

Not everyone is gonna automatically be eligible for that loan out-of every bank. If you think that you fulfill all of the standards, however you however rating rejected, there are also several things that can be done.

Increase Credit history

A common reasons why people get knocked right back regarding providing an effective personal bank loan would be the fact its credit score is too low. Should this be the situation, zero amount of begging will work youre either going to need to obtain a loan provider one will accept your own all the way down get or focus on raising it.

Rating work you to Pays

One more reason why a lot of people gets denied of financing would be the fact its income is not high enough. The simple option to this might be to obtain a position one pays above the lowest called for. Taking a higher-paid down business can not only indicate that you’ll be able to unexpectedly getting qualified to receive a loan but are far more probably afford the latest costs.

Pertain which have a beneficial Cosigner

Never assume all unsecured loan loan providers makes it possible to sign which have a cosigner, but if you find one that does give it time to, in search of anybody prepared to sign to you will increase the possibility of getting accepted.

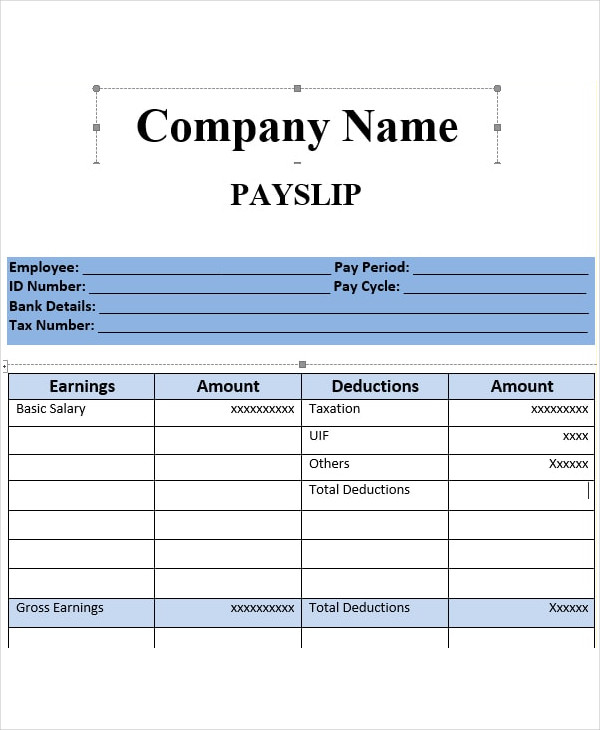

How can i Show My personal Income Easily am Worry about-Operating?

Appearing your earnings whenever you are worry about-working shall be difficult. How you can do that should be to amuse lender suggestions and therefore develop will show that you will get a minimum number from payments 30 days.

If you’ve been care about-utilized for more 1 year, following demonstrating your own previous tax returns is yet another long way out of appearing notice-functioning income. Lastly, if you use accounting application one tunes payments, following this is fast cash loan phone number certainly several other helpful unit

How to Show My personal Earnings Basically Get money within the Bucks?

Should you get paid in dollars, next this adds an amount of complications to show you features a source of income. The simplest way is to try to ensure that you hold statements and you can receipts, so you can show should you get paid and just how far to own.