The average cost of a marriage possess ascending. The expense of wining and you will eating a few family and two sets out-of family unit members is commonly a major expense. Include formalwear, bands, vegetation, prefers and you can a good rehearsal restaurants and you will be looking on lots and lots of dollars (or higher!). Specific lovers enjoys deals they could used or better-heeled mothers who happen to be prepared to assist.

Relationships Funds: The basic principles

A wedding financing is an unsecured loan that is created specifically to cover relationships-relevant expenditures. If you have already done particular wedding planning you will know there is a massive upwards-costs getting something that provides the phrase wedding connected with it. A leg-length white beverage skirt could cost $200, however, a knee-duration light skirt charged while the wedding gowns? $800 or maybe more. An equivalent will applies to signature loans.

After you initiate doing your research private finance you can note that there are many loan providers available, out of conventional finance companies so you’re able to credit unions and you may fellow-to-peer lending web sites. All these keeps highest-interest-speed choices. It is they smart to undertake these funds? Perhaps not.

Most of the debt is actually a threat. The better the rate, the greater the danger. For people who have to have a married relationship mortgage, you should besides shop for low interest rates. It is preferable to find funds having reduced or no fees, along with zero prepayment punishment.

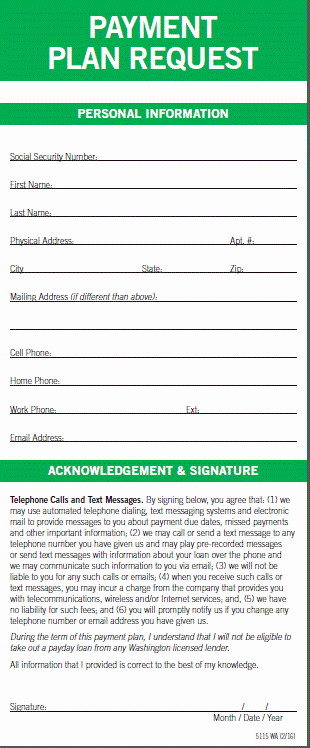

To try to get a married relationship mortgage you will have to submit to a credit assessment and you can glance at the typical mortgage underwriting techniques, because you manage with a regular unsecured loan. The greater your own credit, the low the Apr (Annual percentage rate) is. Your wedding day financing will additionally come with that loan title. The new terminology are often around three-years however some is actually once the much time as the 84 weeks.

Definitely, some people always fees matrimony orders on their credit cards although unsecured loans are apt to have all the way down rates of interest than just playing cards. Before you place your matrimony expenses into the synthetic, it might be a good idea to speak about unsecured loan selection. When you are facing monetaray hardship or issues, you’re in a position to qualify for a wedding give one will help you to build your relationship desires become a reality.

installment loans no credit check Alberta MN

Try Matrimony Fund best?

For folks who as well as your required with her have one or two good, middle-to-large income, repaying a marriage financing may be easy. Yet, if your money is the fact highest, why-not waiting and you will save up for your relationship? Think about what more you certainly can do toward money you’ll dedicate to attract money to have a marriage mortgage.

Without having the type of incomes that would generate trying to repay a marriage loan in balance, investing a loan is economically risky. The same goes having partners one to already bring a great deal of personal debt. Had home financing, auto loans and/otherwise figuratively speaking? Therefore, it’s best to think before taking to your more debt.

Whichever your role, its worth exploring relationships funding choices that’ll not make you in obligations. Do you really have a smaller, more modest relationships? Do you really decelerate the marriage go out provide yourselves more time to store right up? Nevertheless perhaps not convinced? Education point to a relationship ranging from large-pricing wedding parties and better separation and divorce cost. A small celebration is the ideal thing for the bank accounts plus dating.

If you choose to pull out a wedding financing you could potentially be interested in relationship insurance policies. For a few hundred or so bucks, a marriage insurance coverage usually refund you whether your venue happens bankrupt, a condition waits your own nuptials or your own photography manages to lose all photographs. While you are bringing the monetary likelihood of purchasing a marriage having a loan, it may make sense purchasing on your own a little serenity out-of head that have a wedding insurance.

It is preferable to buy to make sure that you might be having the finest sales to your the mortgage and insurance policies plan. Prices are very different widely. If you know you may have a while prior to you will need to obtain the money, you could start dealing with thumping up your credit score. Look at your credit file to have mistakes, build into-time repayments and keep your own credit use ratio during the otherwise below 30%.

Realization

We are inundated which have images regarding costly wedding receptions within culture. It’s easy to take in the content your merely relationships worth that have is the one one holiday breaks the financial institution. You might consider remaining things more compact (or perhaps affordable). Its likely that your wedding day is not necessarily the past larger expense you can easily face just like the a couple. Consider how will you purchase property get, children’s educational costs and later years for folks who start your marriage by using on a big amount of obligations.