Whether you’re trying to build brand new counters and you will shelves out-of your own get a loan Johnson Village CO dreams, tear out a wall and you will increase your learn shower, spend money on an excellent fixer-upper, otherwise start around scrape, a renovation build loan can be their solution to creating an effective place well worth showing-off.

What exactly is a renovation Structure Financing?

A repair framework mortgage talks about both the cost of buying a great home while the cost of starting biggest home improvements. It is different from a classic house refinance because you are borrowing from the bank contrary to the value of your home after the home improvements is actually done. These financing is a good choice for anyone looking when deciding to take advantageous asset of the elevated equity on the household one to this new upgrade can lead to – and when brand new upgrade could add too much worthy of so you’re able to the house. The mortgage count will then be according to the expected worth shortly after renovations.

The greatest advantageous asset of a renovation design financing is actually you are able to purchase and you can ree go out, whenever you are nonetheless to make you to definitely monthly payment to fund one another will set you back. You don’t have to value taking out fully the second mortgage adopting the buy – more than likely from the a higher interest – and you may start solutions / renovations just after closing. A lot more gurus become:

- That application and another closure

- They broadens your own readily available home and you will living area solutions.

- You could modify a home towards wants ands requires.

Other kinds of Design Loans

Construction-to-Long lasting fund finance the building of a different sort of domestic right after which convert toward a fixed-price mortgage given that home is finished. That it mortgage kind of is best for residents who wish to rescue with the settlement costs and lock-inside the money during the an excellent rate.

Construction-Simply loans is a primary-term, variable-speed financing that is used to accomplish the construction off good domestic. Immediately following structure is accomplished, the loan have to be paid down entirely or refinanced with the home financing. That it financing style of is a good choice for candidates that have a lot of cash readily available from the revenue of the earlier where you can find pay back the development mortgage.

Owner-Creator finance are around for residents who can have indicated experience as an effective homebuilder or feel the proper licensing. For those trying ditch a third-group company and would like to act as their standard specialist, these types of fund is actually for you.

Measures to getting a property Financing

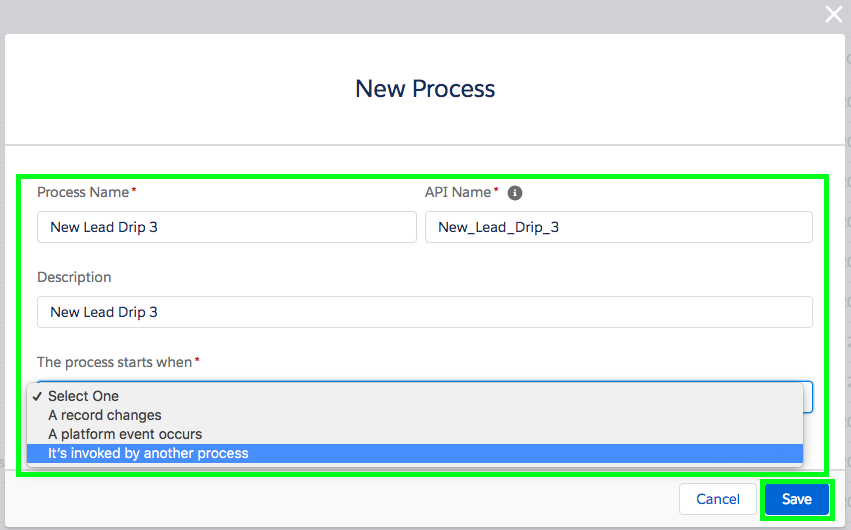

![]()

While you are considering resource a house renovate playing with a renovation structure financing, some tips about what that process manage look like:

1: Enterprise Criteria

Financing criteria to own design financing is somewhat more strict than simply men and women to have a timeless home loan because there is zero equity but really. Often the borrower will have to deliver the lender which have:

- Current Tax statements and you may Financial Statements (i.elizabeth. debt-to-income ratio, credit history, an such like.)

- Feasibility and Venture Info: floorplans, interior and additional helping to make, city programming conditions, and first selections and you may product description

- Structure Finances and you will Timeline – framework will set you back together with property costs, devices can cost you, and you will softer will set you back (we.age. courtroom charges, it allows, insurance policies, etc.) if in case they’ll be accomplished / reduced.

- Government Effectiveness and you will/or Constraint Lovers to complete the development

Step 2: Lender Proposal

Pursuing the a look at the project requirement, the financial will prepare financing suggestion suited to your position due to an underwriting processes. The newest amortization schedule and you can interest are very different regarding opportunity to enterprise, but you may basically expect to pick a predetermined-speed five-season financing. If you are a corporate looking to fund build for the industrial space, you can also qualify for a keen SBA loan alternative instead.

Step three: Allowed and you may Appraisal

The main structure loan application processes was an assessment over by financial. Since you, the brand new borrower, need to pay into the appraisal of the design website, it always observe the latest bank’s financing proposal. The bank can only mortgage according to the assessment value of assembling your project and is significantly important to finalizing the borrowed funds arrangement. In case your appraisal really worth is available in in the otherwise over the full project costs, you are advisable that you flow on the closing. When your appraisal value will come in using your total investment rates, you will need to posting your capital request or bring way more security toward financial.

One thing to note is that there clearly was an appraisal that takes place both before build opportunity initiate and you can shortly after this has complete.

Step four: Title Really works and you will Closure

The past action toward restoration framework loan process is to try to place the name of the property in the first covered creditor’s title, good.k.a. your. Once that’s over, you will personal your loan, if or not one to getting because of refinancing otherwise paying off entirely.

No matter what the enterprise size, Leading Lender can help you turn your house with the property. Talk to one of the experienced loan providers today to pick a great resource service greatest customized for you.