Mortgage loans for Winners proposes to pay money for all of the charges and you will closure costs to the a separate house. The application includes no app, processing, underwriting, or relationship costs. Keep in mind, this really is more than likely in return for a higher level.

Home loan getting Winners says you to definitely their residence mortgage apps you need absolutely nothing if any down payment, there are low rates, and also the credit score criteria are down.

USDA Fund for Government Employees

USDA loan facilitate members of rural and you will residential district areas. This can be a national supported financing that you can get 0% off having and perhaps score lower interest levels.

Just be sure to plan to purchase a home within the a good rural city there is actually income advice and household really be found from inside the an effective USDA designated outlying urban area. Find out more.. [ USDA Financing ]

Even though there may not be many federal staff member geared property programs, that does not mean a national personnel is always to eliminate a few of the more well-known financial options.

Getting accepted having a mortgage while the a national personnel is actually the same as what someone who work from the private industry will have to carry out.

As with all somebody wanting to get yet another home, you can find strategies just take to ensure that you are located in the very best location to getting recognized.

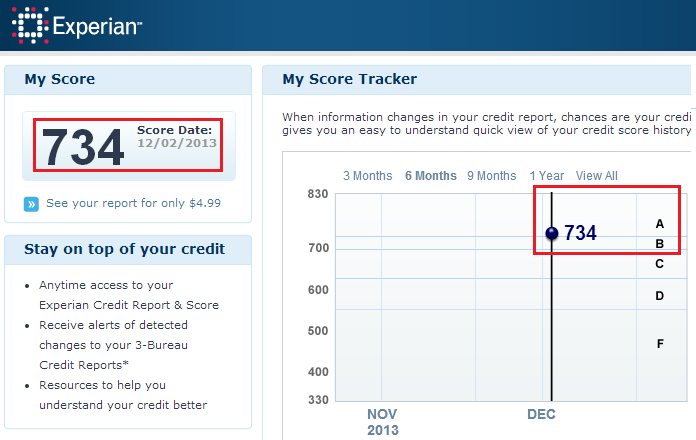

Look at the credit score! Though there are software that will allow/manage less credit rating, it’s still vital that you work at best borrowing.

Remark their rating and you may credit file for errors. If the you can find errors, you may need to dispute them that may just take days. This needs to be over from the direction of a good mortgage administrator .

Of numerous loan providers need to find a credit history from in the minimum 620. With of the authoritative mortgage software, the speed is appropriate at the 580 or even at the a 500 rating. But not, the lender have a tendency to legs a few of their recognition choice through to exactly what is largely on the report, not simply brand new get.

A unique factor that lenders will in the will be your Loans in order to Income (DTI) proportion. The debt you are obligated to pay, such as for instance mastercard money, money, or other bills will likely be from the 30% otherwise less than exacltly what the month-to-month money try. The reason one to loan providers consider this is that they want to make sure you can in fact repay the mortgage.

Very mortgage programs wanted a-two season work background. They appear getting a complete two-year history of performing complete big date with no openings for the a career. When the you tribal based payday loans no credit check can find holes, that which was the reason? Quick holes from inside the a job is actually ok but you’ll must was basically back again to benefit at the very least 3 months.

Lenders will ask for 30 days regarding shell out stubs, history a couple months bank comments therefore the last 2 years W2s and you can Tax statements. If you have W2s but have perhaps not submitted your taxation for the past a couple of years, then you certainly nonetheless get be eligible for a keen FHA mortgage.

Speaking of a number of the actions all the borrower should consider, and it is the same for federal professionals thinking about unique applications.

Area of the distance themself for a national staff looking to buy a house should be to shop around and you will reach out to see what programs are available. Work on your borrowing in advance while having an obvious notion of what your location is. This can assist you in knowing what advice you should need.

Do Government Group Get Unique Mortgage Pricing?

Whether or not lenders s to have government staff, you’ll find nothing in place to provide different rates for all of them at bodies height.