- EMI CALCULATOR

- Qualification CALCULATOR

- Equilibrium Import CALCULATOR

- STAMP Obligations CALCULATOR

- Income tax CALCULATOR

- Home loan Quick Checks out

- How to Submit an application for A home loan

- Home loan Income tax Experts

- CIBIL Get Computation

Highlights:

People whom want to serve as good co-applicant otherwise a good co-signer do not know the difference between the two. Co-borrowers, co-signers, co-people and co-people have additional court and you may economic requirements. With regards to the character you have selected, your choice into loan fees differ too. Ergo, you have to create on their own familiar with the differences between these individuals spots so as that one can make correct choices in what character they can enjoy efficiently.

???Who’s an effective Co-Applicant?

A co-candidate try somebody who offers full obligations to have financing payment. Including, when the Mr An excellent and you can Mrs B have chosen to take a loan to one another consequently they are co-individuals on the a loan, the responsibility of repair Financial EMIs drops one another on the Mr A beneficial and you may Mrs B. To cease any court problems, loan providers generally inquire all of the co-residents so you’re able to act as co-applicants. But not, in the event that good co-owner wants, they could will not be good co-applicant.

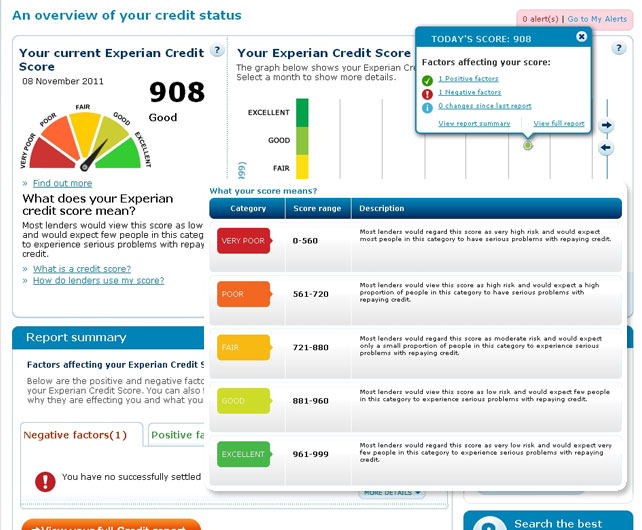

Individuals who desire to get themselves of a mortgage need certainly to meet its lender’s being qualified criteria. Put differently, they must has a stable earnings, a reliable employment, good CIBIL score regarding 750 otherwise over, etc. If one doesn’t fulfill a beneficial lender’s qualifying criteria to own that loan, its application will get refused. In this case, to enhance their house Loan eligibility and start to become qualified to receive a good Mortgage, borrowers can consider incorporating good co-candidate with a credit and you may money reputation. Listed here are a couple of things that folks have to know when they plan so you can serve as a great co-candidate towards the someone’s Financial:

Co-candidates who are not co-owners do not have people right in law along the property up against that the financing could have been pulled.

Co-people who are not co-customers never claim income tax benefits available to Home loan individuals under individuals parts of money Income tax Operate.

??That is a good Co-Debtor?

:max_bytes(150000):strip_icc()/UnearnedRevenue_Final_4187402-aa562f3cdfef4c4ebb22c69bdb055237.png)

A co-debtor is somebody who is just as guilty of mortgage fees as modern debtor. If a person avails from a home loan and adds a beneficial co-borrower, it will be the first applicant exactly who attributes the house Loan EMIs. Yet not, when the for some reason, an important applicant finds it difficult to spend its EMIs otherwise regarding the latest dying of your number 1 applicant, it gets the responsibility of one’s co-debtor to invest the house Mortgage EMIs. Not everyone can act as an effective co-borrower; financing institutions has actually assistance off who will serve as a co-borrower into home financing. As an instance, really lending establishments do not let parents in order to co-acquire financing which have an unmarried daughter that may lead to assets-related conflicts later. In general, many people love to put its partner, youngster, otherwise a primary cousin since a good co-debtor.

If you are intending to simply accept to be an excellent co-borrower towards another person’s loan, listed below are some items you have to keep in mind:

Since you are an effective co-borrower, their credit and money character gets an impact on this new primary borrower’s power to avail of a loan. If you have an excellent credit score and you will a steady job and you can earnings, the probability of the primary debtor availing of your own loan to your helpful small print will increase too.

Co-consumers are not necessarily constantly co-people. Although not, co-individuals who will be also co-residents can allege income tax masters under Point 80C and you may Point 24b of the Tax Operate and you can maximize the income tax offers.

??That is a good Co-Owner?

Who’s a great Co-proprietor? Good co-proprietor try somebody who keeps an appropriate show in the an excellent possessions. Although not, if they do not will end up being a great co-borrower, they aren’t lawfully responsible for paying the loan currency. Yet not, if one borrows money up against a home and you may does not https://paydayloanflorida.net/fruit-cove/ repay it, it stand-to cure the possession of the house plus this situation, a good co-proprietor who isn’t also a great co-debtor might have to been forward and help which have financing repayment to protect the house under consideration. It is ergo that if a person is getting a home loan or financing against assets, it is very likely that the lender tend to query every co-customers to serve as co-borrowers towards mortgage. If the co-people dont want to join once the co-borrowers, they want to at the very least render it in writing which they create not have any objection up against the no. 1 candidate borrowing money once the a loan. Credit institutions do that to make certain you will find judge complications involved at an afterwards stage.

??Who is an effective Co-Signer?

As mentioned before in this article, a single need to satisfy the lender’s Home loan qualifications requirements in the event that they wish to get on their own from financing. If an individual keeps the lowest credit rating and when this new lender feels the risk with it in their mind within the lending money in order to the loan applicant is simply too large, they may ask the borrowed funds candidate to incorporate a great co-signer. Good co-signer has no legal rights along the assets. However, brand new co-signer accounts for loan repayment in the eventuality of financing standard or if perhaps an important candidate finds on their own struggling to pay-off the borrowed funds currency. That have good co-signer having excellent credit ranking may help one avail of a financing at the lower-rates of interest. It can also help one avail of huge sanctions and you can demand financing tenor that really works ideal for them.

??Latest Words

This article differentiates ranging from co-holder, co-debtor, co-applicant, and you may co-signer in loan requests. A beneficial co-manager shares possession of the property, a beneficial co-debtor offers economic obligations into the mortgage, a great co-applicant can be applied as you for the mortgage, and you will a beneficial co-signer guarantees cost in the event your number one borrower defaults.