- What exactly is an FHA 203(k) mortgage?

- Types of FHA 203(k) financing

- Masters

- How to be considered

- The procedure

- FHA 203(k) financing versus. traditional loan

User hyperlinks to the situations on this page are from couples that compensate united states (see installment loans Magnolia MS all of our advertiser disclosure with these range of partners for more details). Although not, our very own views are our own. Find out how we price mortgage loans to type unbiased feedback.

- An enthusiastic FHA 203(k) financial moves the brand new price from a house and also the pricing out of expected solutions to the you to definitely loan.

- A minimum credit history out-of 500 is required to be considered, with down costs only step 3.5%.

- You may also have fun with an FHA 203(k) financing in order to re-finance your existing financial to fund home improvements.

Looking an affordable, move-in-in a position home inside a competitive business is going to be an enormous difficulty. When there will be so much more people than suppliers into the a specific area, you could find your self in a situation in which bidding wars is pushing cost out of the variety you’ll be able to shell out.

One method to resolve this dilemma is to obtain a good fixer-upper domestic about set you should alive and you can fund it which have an FHA 203(k) financing.

What is an FHA 203(k) loan?

An enthusiastic FHA 203(k) loan are an authorities-backed home loan that combines the cost from property and you can the expense of the brand new called for home improvements to your just one financing. Present people also can explore a keen FHA 203(k) in order to refinance.

“Simple fact is that perfect financing toward unappealing house that wont promote,” says mortgage broker Kris Radermacher from Klear2Klose Cluster running on Lincoln Financing Classification. “It permits a purchaser going from inside the and you will negotiate for the an excellent household on the cheap and just have they to the next really worth.”

There are two main version of FHA 203(k) mortgage loans, each with various borrowing limitations and you may allowable renovations. In the event the having fun with an enthusiastic FHA 203(k) to purchase a property, it should be utilized since your number 1 household. They aren’t acceptance to have financing services.

This new fund have fixed otherwise changeable rates, with down repayments as low as step 3.5%. They are used to finance unmarried-family home, one-to-four-unit qualities, plus apartments and you will townhomes less than certain conditions.

Otherwise want to reside in the home during construction, you could potentially funds around half a year regarding mortgage repayments.

Version of FHA 203(k) loans

There are two main style of FHA 203(k) loans with assorted assistance and you will guidelines for how far you might acquire and how the money is utilized. The type you select varies according to the brand new fixes requisite.

Limited 203(k) financing

Such apply to less projects with less standards. They provide to $35,000 to own renovations, with no major structural solutions.

Important 203(k) loan

Speaking of useful for big architectural solutions. Renovation will set you back must be at the least $5,000. A prescription FHA 203(k) associate is needed to track your panels.

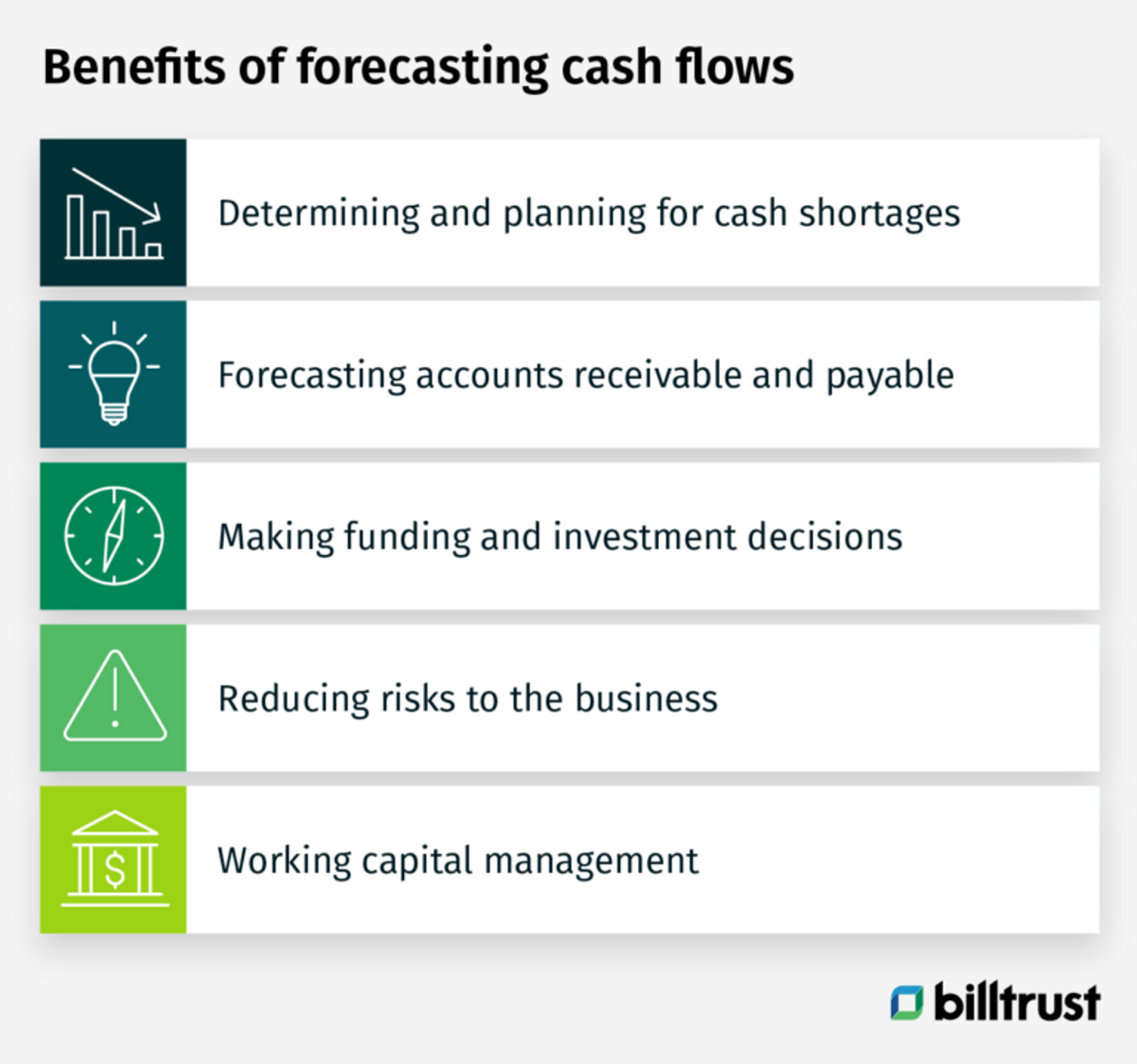

Advantages of an FHA 203(k) loan

FHA 203(k) funds enjoys multiple advantages, and so they are a good fit for both homebuyers and you may current homeowners regarding the correct problem. Below are a few of masters this type of fund feature:

Flexible borrowing requirements

FHA 203(k) mortgages is actually supported by the new Federal Housing Government. The newest official certification are like those to have regular FHA financing, in fact it is simpler to rating than just conventional mortgages. You’re capable of getting that with an excellent 580 borrowing rating (otherwise sometimes 500, dependent on the lender).

FHA money supply low-down commission selection. As long as you has actually a good 580 credit history or even more, you should buy a good 203(k) mortgage with only step three.5% off. That’s $10,500 to your a great $three hundred,000 house.