When looking for a good $five-hundred financing, probably nobody thinks one such as for instance a small amount borrowed will bring with it specific barriers on the way to entry. While the $five-hundred does not seem like far at first, very no-one can very suppose it might be hard to borrow like an amount of a financial and other financial.

Indeed, but not, it is truthfully which small sum that somtimes give rise to an excellent absolutely nothing problem. Since the in balance contribution means that the selection of brand new donor must be very exact. At all, a $five hundred financing cannot be borrowed out of each and every lender otherwise financial.

Whether your debtor opts to possess a beneficial www.paydayloanalabama.com/notasulga/ $500 financing, he then can needless to say freely determine what the bucks off the borrowed funds is used getting. As a result of the small amount, it can be presumed one to individual goods are getting purchased, the latest membership is being healthy otherwise an advance payment is being made for a major purchase.

not, it would also be simple for almost every other family unit members to get offered with the aid of the fresh new $500 mortgage and an inferior investment to get made into the future. At some point, having an effective $five-hundred mortgage having 100 % free play with, the newest debtor can decide by himself responsibility where the currency goes.

At the same time, for people who deal with the fact $five-hundred is not enough on how best to security all your valuable expenditures, we now offers finance to have considerable amounts, including $700. It is sometimes the difference away from $100-$two hundred that may enjoy an enormous role that assist your away on the disease when it’s needed.

Do you know the great things about 500$ pay day loan?

Towards the totally free online calculator, members normally instantaneously see just what costs to anticipate on wanted matter. Because the we will not bring any processing otherwise commission charges, all the prices are transparent.

The borrowed funds questions in the our company is actually credit rating-basic. As a result we do not look at your earlier knowledge of third parties and just glance at the data files which might be called for on the financing

No body wants to enter financial obligation. With our team you aren’t tied up off for very long, but can easily pay-off the money you owe compliment of quick terms and conditions. Such as this, financial difficulties will likely be bridged at the brief notice.

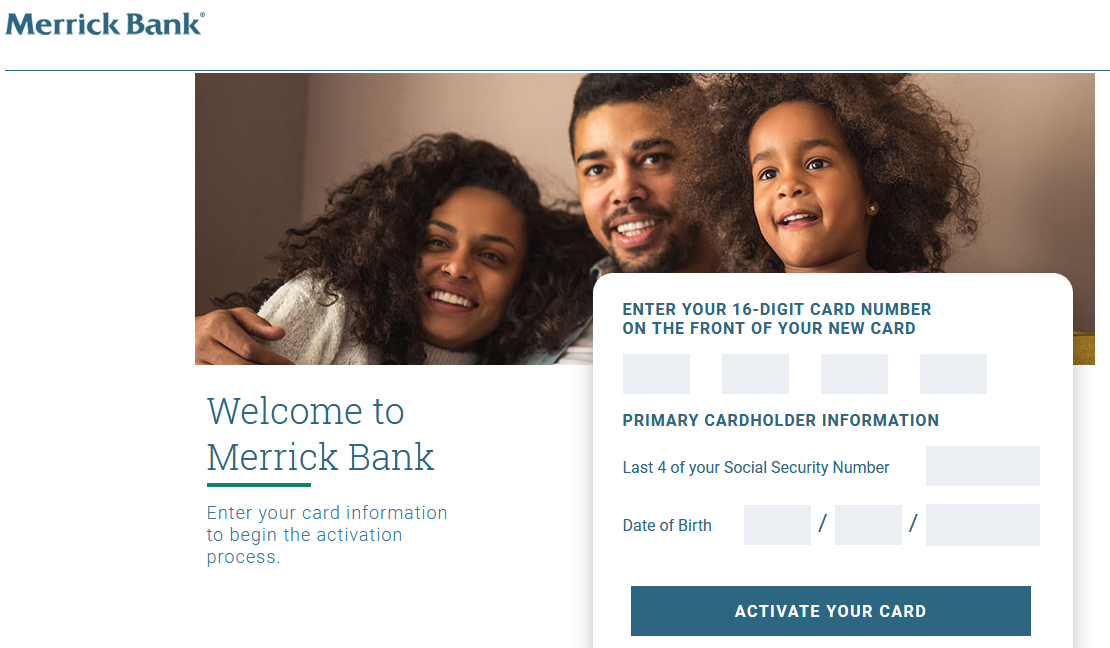

Submit an application for financing: How come a software works?

- Step 1: choose the amount borrowed

Throughout the loan calculator, select the loan amount you desire therefore the label. You could potentially immediately see just what appeal you pay.

- Step 2: Submit a loan application

Now complete another application for the loan and you will upload the required documents. Your loan software program is ready within moments.

- Step 3: Obtain it verified

With on the web five hundred$ mortgage your efficiently end tedious documents. You will be affirmed close to your pc or cellphone making use of the on the internet-form process. Your loan application is now able to become canned.

Exactly what are the requirements?

Exactly like a mortgage, payday loans online likewise have specific requirements for a loan app, while they commonly while the rigorous just like the most other finance companies. You need to be off legal ages and you can citizen of your own Joined Claims. A bank account and you will a regular earnings of at least step 3 days are also necessary. In app techniques, attempt to publish individuals data to get your wanted mortgage. This includes the latest signed price, a browse of the term credit otherwise passport with confirmation out of registration and you can a recently available proof income.

The fresh $five hundred loan having less than perfect credit record without credit check

There are many different consumers who possess a bad credit history because of the failing to pay. Even after a great $500 mortgage, this may become an obstacle when you look at the a financial. In this instance, PAYDAYPLUS fund doing five-hundred can help you see the best bank which focuses primarily on eg also provides.