Consequently you, just like the sole manager or partner about providers, provided to pay the personal debt. The lender are able to seek to assemble repayments from you actually when your company is unable to pay the loan.

This enables you to efficiently a beneficial cosigner, hence form the debt is going to be claimed in your individual credit file. For individuals who in person protected a corporate credit line, this can similarly impression your credit report.

Unsecured loans used to money your company will apply at your own private credit score, and this boasts household guarantee fund also.

Company Playing cards: Of many businesses has business playing cards to handle their cash disperse while increasing working capital. But guidance associated with a corporate mastercard membership appearing on the personal credit history is dependent upon the way the account is established.

While you are a worker out-of a corporation therefore the providers gives you a corporate credit card to have really works expenditures, its impractical so it card will be listed on your credit report. The reason being you are simply a 3rd party company representative out-of the new cards.

But not, small businesses through its individual cards become more than subscribed pages. They are usually yourself encouraging the latest membership making it more likely having providers playing cards to seem on their records and you will connect with their results.

It is critical to be certain that you’re physically ensure that account before signing upwards to have a business credit card. If you use your own mastercard to own team expenditures, upcoming such repayments also show up on your own statement and you may apply at their get.

Nevertheless now let’s view specific actions regarding how you can keep your organization credit history and private credit history independent.

Choose the right business design: If you are a sole manager out of a business, you will find virtually no separation between the company and you may your borrowing.

But going for a family design such as an personal installment loans in Jacksonville enthusiastic LLC, S Corp. otherwise C Corp. may help to independent providers and personal funds. For more information, i encourage speaking to a business providers lawyer otherwise CPA to help you find out what the options is.

Consult your financial: It can be worth asking loan providers to test your own borrowing from the bank accounts having a corporate financing or percentage package. Although not, then it hard recommendations to acquire and as a result affect your results.

One which just agree to one money has the benefit of, its also wise to request the fresh lender’s plan for revealing funds. See agreements carefully to test if they are requesting a personal bank loan be certain that.

Think of, if you signal some thing together with your label instead of the title of the business, you can really end up being kept accountable for the terms of this new deal.

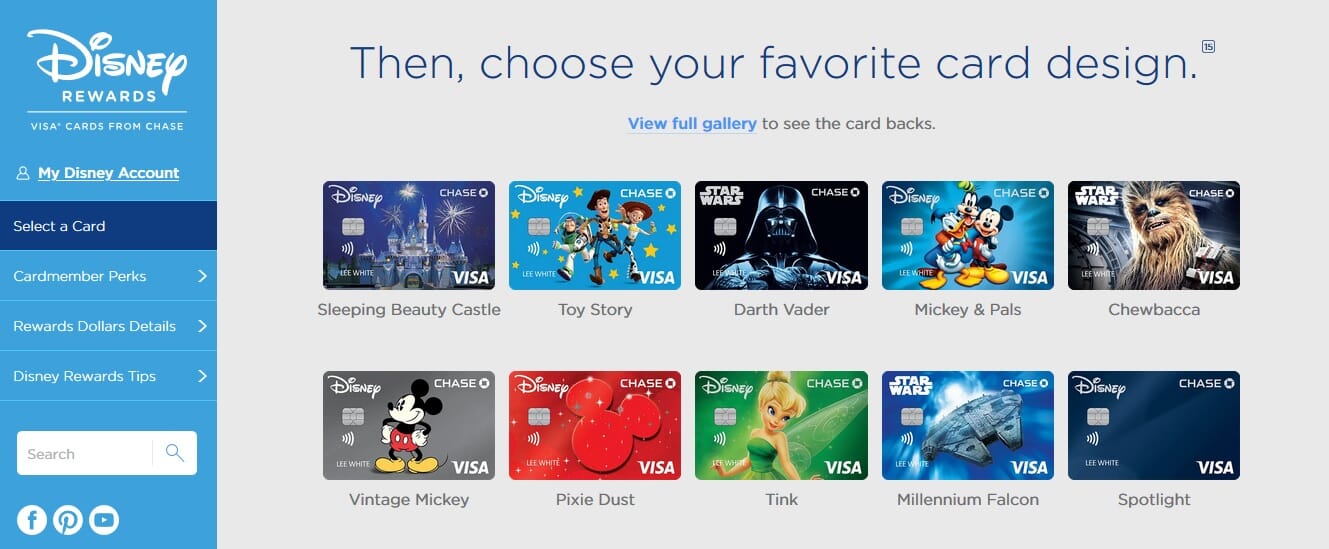

Choose the best organization credit card: You will find several team credit cards available to choose from which do not consistently declaration craft so you’re able to credit revealing firms.

At the same time, which have working capital finance, the lender is much more worried about the fresh new historic fitness of one’s money channels and you can equilibrium sheets in place of your credit score

But not, it just enforce when repayments are manufactured on time. All small company charge card have a tendency to declaration for many who default on new cards.

Financial obligation impacting loans

When you have obligations or a minimal private credit rating, this may impede customers for a business loan. It all depends with the in case your company provides a get off a unique and what sort of providers company youre.

Particular loan providers may only be thinking about your company credit history or background. Even as we have in the above list, this is usually claimed from the about three significant organization mastercard bureaus (Experian, Equifax, and you will D&B).