Personal loans from inside the Singapore

Money insufficient is a very common refrain the majority of us hear, far more thus nowadays whenever rising cost of living try biting more complicated than good rottweiler.

Because you pick a method to mat your money, you may have come across personal loans and you can questioned when they just like borrowing from the most readily useful pal.

Which is simply half-right such as for instance finance really are for personal have fun with, but there is however way more to them than are a straightforward method for the money. Read on to determine just what signature loans was, and whether or not they could well be all of our best friend around those people adorable canines is.

Just what are signature loans?

Signature loans are just what you borrow out of banking companies and you will financial institutions for your own fool around with. Should it be splurging on that sinful fulfillment, donating to possess a great end up in, otherwise filling it significantly less than a cushion, you may be generally free to do almost any their cardiovascular system desires towards currency in the event with respect to monetary punishment, it might not be best if you overindulge towards borrowed money.

Label financing

When you’re a good stickler having balance and you may certainty, up coming a term loan are for your requirements. That’s where a bank lends your a single-regarding share with criteria decided upfront for the duration of the loan:

- Interest rate: Generally six%-8%

- Fees several months or tenure: Constantly step one-five years

- Month-to-month instalments.

Idea #1: Of numerous banking institutions render a lesser interest to possess a lengthier loan course. However, it often means a larger total fees. By way of example, pursuing the over example, a yearly interest rate of five% more cuatro decades will mean an overall high attract out of $dos,100000 rather.

Idea #2: You could request early complete cost. Although lender may charge an earlier loan termination percentage to help you compensate for their loss of desire income.

Rotating mortgage

Consider a beneficial rotating financing if you like a more fluid and flexible cure for control your credit. Referred to as a personal credit line, such loan acts such credit cards.

You could potentially withdraw partly or totally of a beneficial pre-accepted borrowing limit, and you may attention simply relates to the sum of borrowed. Just how much to repay every month can be you, and you can all you come back usually renew the mortgage number for your requirements to store borrowing and no end time. Even when finance companies constantly demand at least payment per month.

The fresh new hook so you’re able to eg independency is the fact these money carry good highest rate of interest compared to an expression mortgage, generally away from 18%-20%.

Tip #3: It ount each month. But eg credit cards, this can snowball punctual from the highest interest. A guideline is to pay off as frequently and as very early that one may, once the rather than term fund, there’re no early payment costs.

What are the results when you cannot pay-off a personal bank loan

Part of why are unsecured loans attractive is that its a beneficial style of unsecured borrowing; you don’t need to place on equity or have a beneficial guarantor to truly get your on the job the cash. If you’re unable to pay back that loan, the lending company try not to seize your personal property, as opposed to a property otherwise car finance.

Nonetheless it doesn’t mean it’s your rating-out-of-jail-free credit. Defaulting on your own mortgage is poorly apply at your credit rating , and this methods how most likely youre to repay your debt and you can derives out-of details offered to the credit Agency Singapore (CBS) by your borrowing team such as banking institutions and you may finance companies. A woeful credit get could harm your future borrowing plus job opportunities.

In more significant cases where the financial institution seems you happen to be purposefully withholding payment, they may and additionally get lawsuit against your.

The reasons why you might require a consumer loan

Money for items like homes, repair, and cars can only just be taken toward given mission. Commonly, the lending company disburses the cash right to the brand new company otherwise dealer, bypassing the brand new debtor totally.

In addition, a personal bank loan happens to your own wallet and you will affords far greater free play in the manner you spend the cash. You could potentially choose to use it in one resting otherwise divvy right up a variety of expenses for example:

- Medical and other emergencies

- Goals or existence possibilities, elizabeth.grams., wedding receptions, getaways, big-ticket items like electronic devices

- Degree

- Business or front side hustle

- Debt consolidating having fun with a personal loan to settle several other a fantastic personal debt which have a higher interest rate, age.grams., handmade cards

- Versatile fool around with

Simply how much might you obtain?

To help you a loan provider, nothing else issues aside from your capability to cough right back the fresh new money on time. Your revenue together with credit history is certainly going a long way so you can decide how much you might acquire.

To have financial institutions, this usually means that 2-6 days of their month-to-month paycheck, capped at the $2 hundred,100000. Separately, licensed moneylenders need to comply with the following financing hats set of the Ministry off Laws :

Suggestion #4: Along with more substantial financing, a good credit score may also will let you delight in a beneficial so much more beneficial rate of interest.

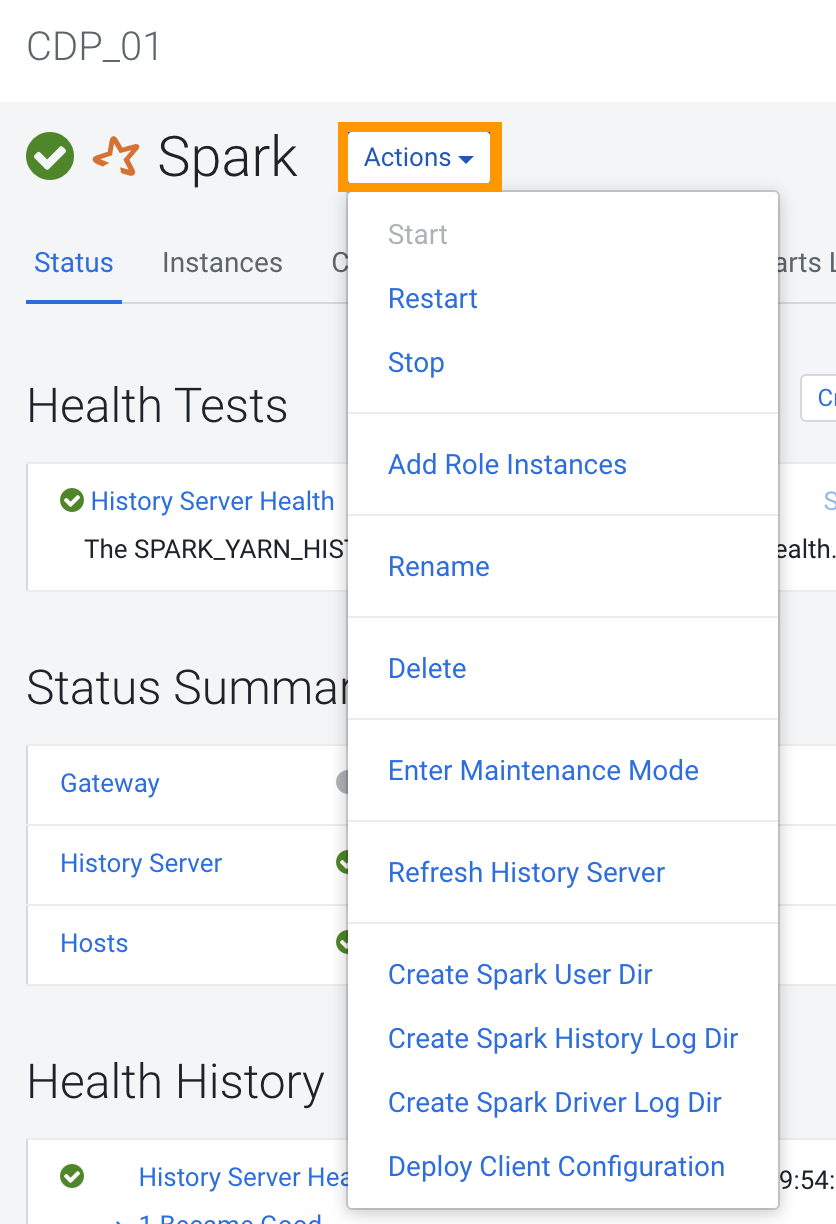

In which & just how to apply

The authorities enjoys a virtually vision with the personal credit for the Singapore, and not you can now dish out such as for example financing. Banking institutions and you may signed up moneylenders is legal by far probably the most well-known choices.

Some wanted during the-people software, some financial institutions allow you to incorporate online if you are an existing customer. Generally, might request evidence of the term, target, and money. Lenders might also research your credit score towards CBS.

Your age, nationality, and earnings may be the step 3 important requirements with regards to so you’re able to assessing your loan qualifications. Here’re the general assistance:

What is less popular is that banks tend to prefer a minimum credit history of just one,825 too. And this before you apply, it’s advisable to check on your credit score into the CBS. You can buy your credit history from their store to possess a moderate payment of $6.42 that have GST.

Besides the loan amount, interest rate, and tenure, it can also help so you’re able to clarify upfront into the lender toward one hidden charges for example:

Approval and disbursement can take as fast as twenty four hours in the event the all the docs come into purchase and you’re considered creditworthy.

Bringing a personal loan inside the Singapore

As with all one thing money, it pays as wise when determining whether you need a good personal bank loan and you will and this bank to choose.

Quite often, such as loan 5000 dollars money serve as short-identity capital. Borrow within your form and you may find that these may actually be a convenient mate in the event the and in case in need of assistance.