Fruit Fund

Apple Financing allows you to bequeath the price of up to five Fruit products in-store using one single software for every financing.

It indicates you simply use shortly after, and only you to borrowing research might possibly be complete (as opposed to a card check for each person tool funded).

While it is you to application procedure, per Fruit unit funded are certain to get an alternative borrowing from the bank arrangement, mortgage account and Direct Debit fee. Including, you could potentially buy one Fruit unit playing with finance while the percentage means and, in the event the acknowledged, it is one to loan. If you choose to get about three Apple activities at the same day having fun with money you’ll incorporate immediately after and you may, if the application is approved, you will have three independent funds.

Having fun with independent money for every single Apple device bought means new cost of money and exactly how enough time you have got to pay back new financing can be designed on the Apple tool you buy. Consequently the eye rates and you may installment episodes might not all be a similar, even if you build just one software.

Frequently asked questions

- Become about 18 ages or old

- Possess a mobile phone matter and you can email

- Have been good British citizen for around three years (leaving out the fresh new Station Isles and the Isle off Guy)

- Be reproduced, self-functioning otherwise retired which have a consistent money in excess of ?500 30 days

- Be up to time with the most other borrowing from the bank costs instead of present defaults, County Legal Wisdom (CCJ) or bankruptcy

- Have an effective Uk bank account from which Direct Debits will be pulled.

How can i check if I am entitled to apply for Fruit In-Store Money? How can i check if I’m eligible to sign up for Fruit In-Shop Loans?

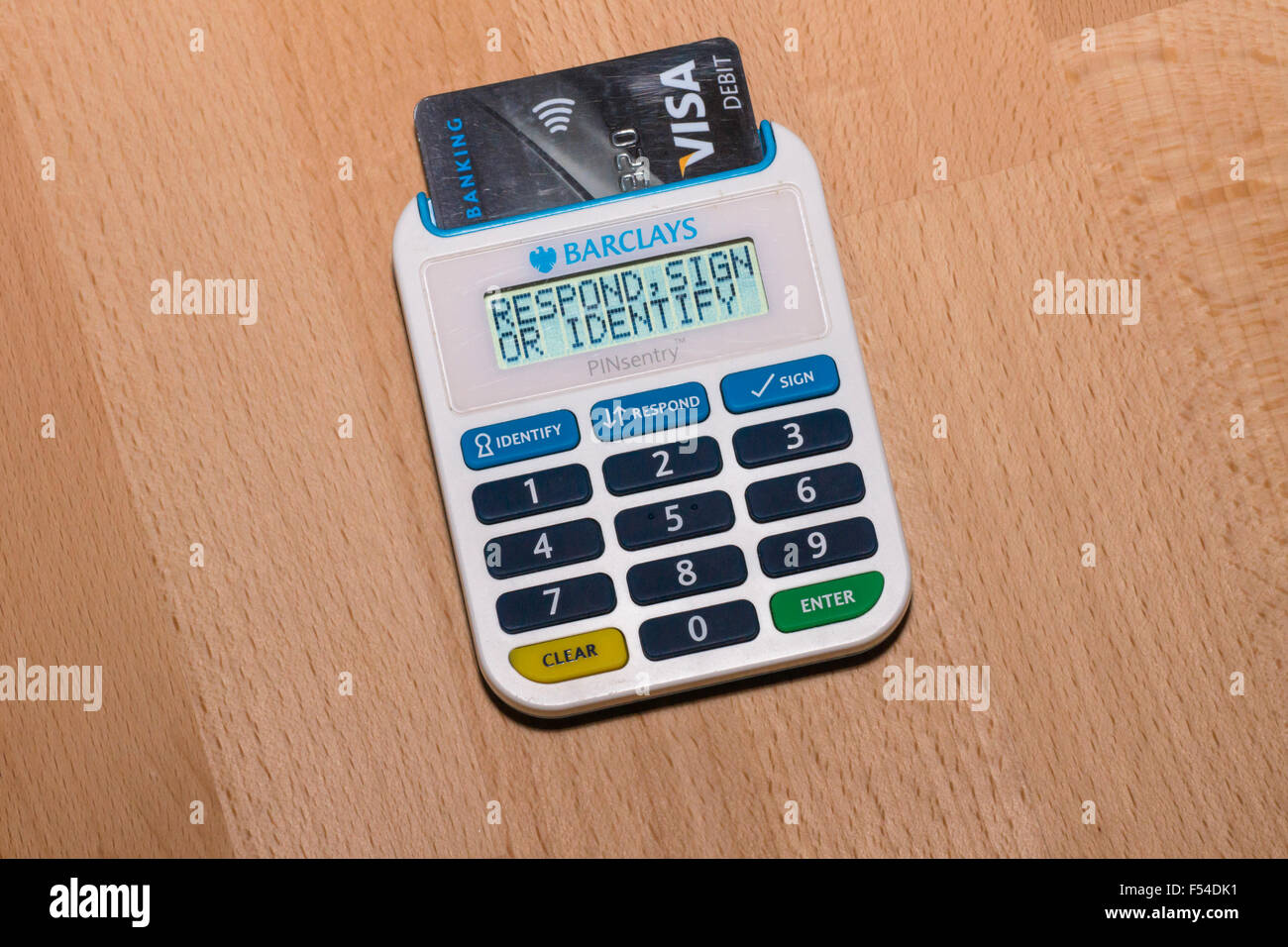

The latest Barclays Eligibility Examiner can be found for you to verify that you’ll be eligible for loans before you commit in order to a full fund application. This can be done by browsing the fresh QR password from the Apple shop on your own individual unit.

You’re going to be expected to get in a few secret bits of pointers to see if you will be entitled to apply. This will be predicated on automated choice-and also make installment loans in Utah and you may a flaccid borrowing from the bank research which won’t impact your own credit rating.

Barclays have a tendency to show your details that have credit reference agencies and you may scam cures businesses to handle the new smooth research. For additional information on just how Barclays play with, shop and look after your data, excite comprehend the Barclays Spouse Funds privacy policy.

What’s the difference in a delicate borrowing from the bank search and you will a difficult borrowing from the bank browse? What is the difference between a silky borrowing browse and you can a hard credit research?

A silky credit look would not perception your credit rating. Alternatively, it is going to show up on their credit reports as a flaccid look, meaning it will likely be noticeable to your, although not to other loan providers. Tough borrowing from the bank looks could affect your credit score and you will be visually noticeable to almost every other loan providers whenever looking at your credit history. A hard credit lookup could be achieved if you fill in the full application to possess fund.

Additional factors you to definitely borrowing from the bank resource organizations have a tendency to imagine are the count away from loans applied for, while the level of software close up.

Opening several this new account meanwhile or perhaps in an excellent short time may perception your credit rating and you can capability to grab out most other financing. Expenses completely to have reduced worth items, instead of paying having loans, may help slow down the effect on your credit rating.

My application having Apple From inside the-Shop Financing was accepted. What takes place second? My application to own Apple Inside the-Store Funds was approved. What takes place 2nd?