Understanding the affairs relating to FHA’s capital words within the twenty five year several months after the the beginning within the 1934 has actually extremely important rules effects to have now. Basic, this new homeownership speed increased away from 63 % into the 1994 to help you 69 % when you look at the 2004, a time period of large and broadening leverage. 2nd, to your the present homeownership rate handling the level attained into the 1960, many look for increased leverage while the solution (WSJ: Low down mortgages picking up; certain come across opportunity for the market in order to win back energy).

Thus delivering so it history right was central so you’re able to comparing if or not formula guidance will in actuality get to the desired goal of promising sustainable homeownership and strengthening wide range getting lowest- and you will moderate earnings and you can minority property.

Starting lookup of this kind is the best over using credible primary and you may second files regarding several months (many data cited arrive: AEI bibliography regarding historical houses finance files). It is very crucial that you fool around with analysis offer appropriate for the context. Instance, new You.S. Census Bureau investigation into nonfarm control rate most useful shows style with the several months before 1960 and particularly prior to 1930, compared to complete homeownership rates cited by many including UI. Once the found from the chart lower than, ahead of 1960, the general rates is greater than the fresh new nonfarm price. This is due to the farm rates getting significantly more than the nonfarm speed. Because of the 1960 the brand new migration regarding the farm sector had mostly work on their path plus the several homeownership trends substantially matched. One another series reveal that 1940-1960 is a period of unmatched boost in the brand new homeownership rate-3 x how big the greater amount of previous six fee part boost detailed significantly more than and you may, in the example of the new nonfarm series, double the sized the increase from 1900 in order to 1930. It offers contributed one or more observer to see that 1940-1960 nonfarm trend was at part a continuation of the pre-1930 nonfarm pattern (blue range).

It can be important to locate any studies things anywhere between decennial censuses. To your period 1940-1960 its fortunate that the Census Bureau wrote four intra-census home ownership investigation products (just step three are provided with the graph lower than). This enables this 20-year age of unmatched homeownership gains are assessed having fun with less schedules.

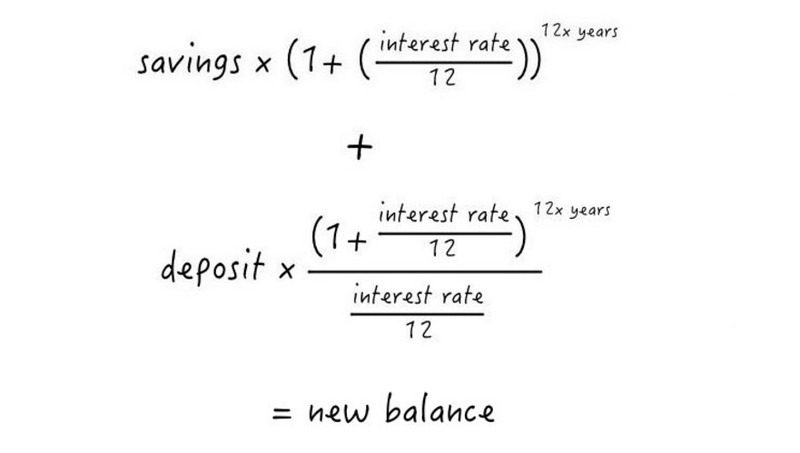

They matters greatly if or not FHA’s fund was indeed highly leveraged (low-down costs along with a 30-12 months name) or meagerly leveraged (larger down payments along with considerably reduced loan terms and conditions)

You homeownershipSource: You Census Agency, 10 years cost is to own decennial census, rates to own November 1945, April 1947, and you will December 1956/January 1957 are from All of us Census products.

- loans Buena Vista CO

- The newest nonfarm possession speed for everybody racing rose to 61.0% in the 1960 off 53.4% for the 1950 and you can 41.1% into the 1940, upwards 19.nine ppts. (48%) regarding 1940 in order to 1960.

- The fresh new nonfarm ownership rates to own blacks flower so you can 38.4% within the 1960 away from thirty-five.2% from inside the 1950 and you may 23.9% inside 1940, up 14.5 ppts. (61%) out of 1940 in order to 1960.

Nevertheless Urban Institute (UI) while the FHA wade subsequent and you may attribute which result to very leveraged fund, specifically ones which have low-down payments and 30-year terms

Ergo 62% of your full 19.9 percentage area gain for all races taken place into the very first 50 % of that time and you can 78% of your 14.5 percentage area acquire to have blacks took place for the very first 1 / 2 of of period. Its distinguished 53% of one’s full rise in total homeownership speed got occurred of the November 1945. Since indexed prior to, this has been attributed to wartime lease control. Obviously a study of FHA’s LTV and you may loan term procedures and techniques throughout locations of the 20-year period is in purchase.