The latest Federal national mortgage association HomeReady and you can Freddie Mac computer Home You’ll programs is actually practical alternatives for buyers which have lowest results. FHA mortgages and show possible but require a great 10% down payment having score less than 580.

If you are searching buying a house, it is possible to fundamentally you prefer high credit scores. The best costs will always kepted getting individuals that have a 740 credit score or even more.

Just how Your Financial Speed is determined

Financial rates vary similarly to fuel cost in reaction to a host of additional details. Most of brand new volatility is actually caused by industry pushes and you can economic signs you to definitely demonstrably try beyond the control over people single people or business.

- Your own personal credit rating

- The downpayment dimensions

- If you find yourself self-employed versus. a member of staff

- The loan label duration (15-season fixed and you may 29-12 months fixed would be the popular)

- The loan tool (variable rates against. fixed)

- Financial symptoms such as for example rising prices, the utilization price, and you can craft on stock and thread markets

- Different places possess quite different prices

- Loan providers have some more prices

When jobless rises, the Government Set-aside often lowers rates of interest assured of stimulating new benefit from the promising investment, which often shoots employing. This new Fed kept small-title interest rates near zero on the COVID-19 crisis.

Possible homebuyers is always to discuss with multiple loan providers, due to the fact costs can differ quite anywhere between some other home loans and establishments. Like, finance companies that have a large increase away from applications you are going to temporarily increase pricing in the event that its loan officials started to their control capabilities.

With respect to the Individual Monetary Cover Agency, today’s financial prices and you will expenditures like origination costs even more differ centered on place, and that after that helps the thought of getting numerous financing quotes.

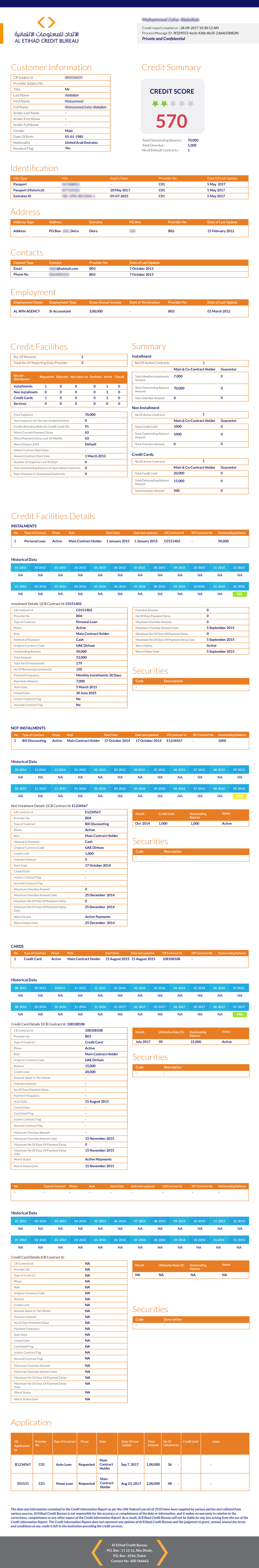

Your credit score stands for a life threatening reason behind eligibility to own a good financial, being qualified getting advantageous rates of interest, and usually influences most other secret financial words within this a home loan.

Customers can get get a free duplicate of the credit history for each seasons away from Experian, Equifax, and you may Transunion; the 3 major organizations one to assemble and statement the financing records out of You.S. consumers. Specific credit card issuers now together with give credit history because of their customers.

So you’re able to initial present a credit score, a customer commonly generally speaking you want a cards membership which had been unlock for a couple weeks. Will, those without any situated credit rating you’ll make an application for a guaranteed charge card or envision a credit creator loan as a way of going started.

Loan providers make use of the financing applicant’s credit history as a means from assessing another person’s creditworthiness. The credit advice lets the possibility bank to gauge exposure, based on the borrower’s likelihood of paying the loan amounts.

New Fair Isaac Enterprise (FICO) are an organization that uses the data within the borrowing from the bank bureau are accountable to estimate an effective numeric score you to definitely selections of 3 hundred in order to 850. The brand cash loans Perdido new FICO score formula techniques requires the applying of an exclusive algorithm.

Lenders legs the decisions from approving otherwise doubting an interest rate another FICO score as well as the actual data during the borrowing profile too.

Simple tips to Improve Credit history

You will find a number of suggests getting improving your credit history. The initial step need obtaining duplicates of credit reports so you’re able to pick any potential errors that can you prefer correcting, for carrying out a beneficial baseline or starting point and you will mode a goal.

Demonstrably identify new payment dates for everybody monthly payments as the a keen most reminder. Constantly making the monthly installments on time is a must for the boosting your credit history.

Begin by repaying playing cards or any other different loans, that may alter your credit usage rates otherwise ratio. So it calculation just shows the brand new portion of obligations already due relative with the complete credit limit-strive for below 10%.